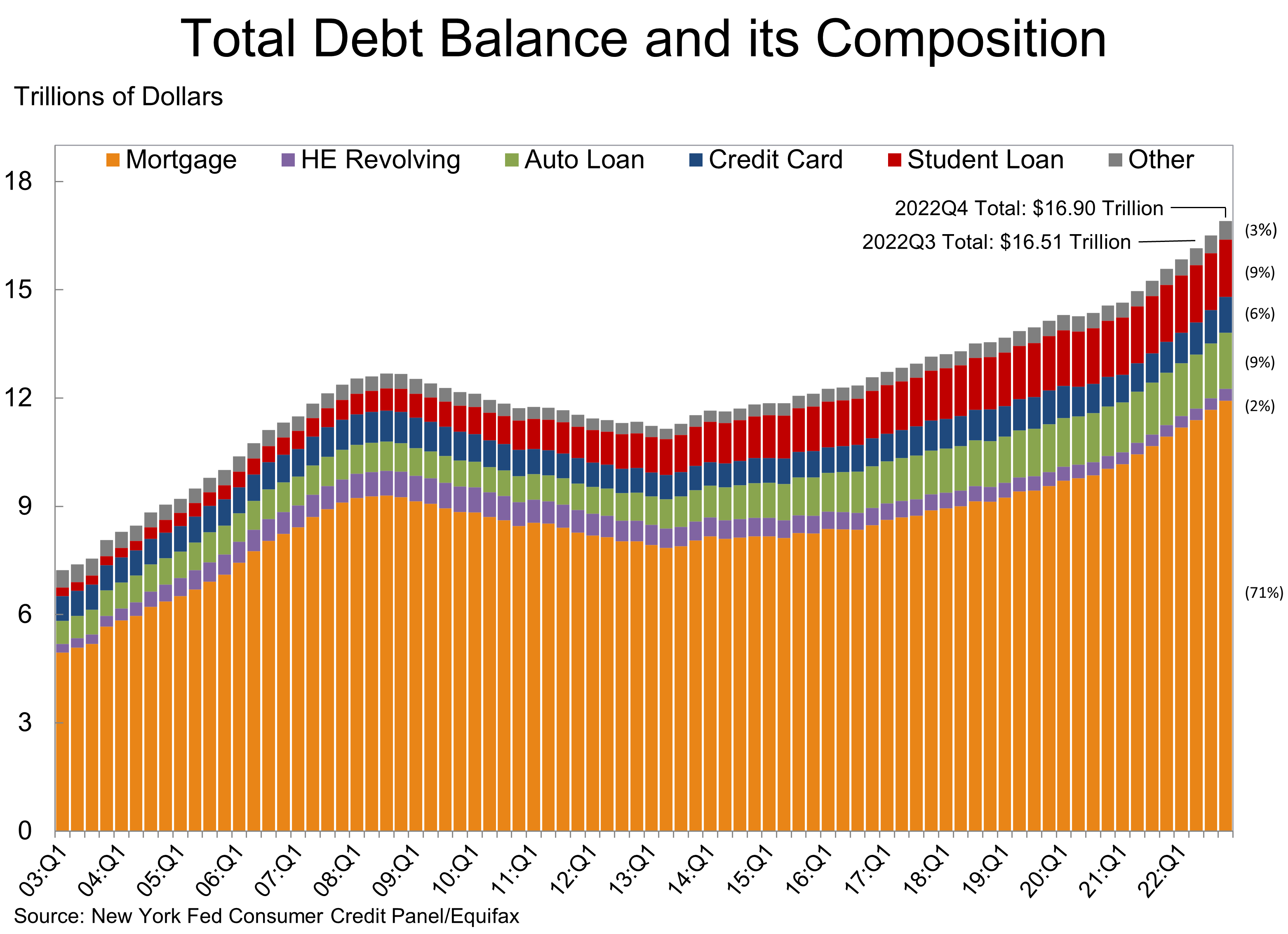

After the economic stimulus packages of the pandemic years, consumer debt has grown progressively to a record-setting level. This unprecedented level of debt has yet to slow consumer spending, which jumped a seasonally adjusted 1.8% in January from the prior month, the largest increase in almost two years. With such high levels of debt, can these levels of spending continue? To better understand the current situation, occam dives into the anatomy of delinquent accounts as well as consumer spending preferences in an inflationary environment to provide a look at the reality of consumer debt.

After turning into savers during COVID, consumers have morphed back into net spenders. According to occam data, a third of American consumers have fallen behind on their bills. Millennials are faring the worst in terms of trying to keep current, and less surprisingly, so is the lowest income cohort. Focusing on credit card debt, the data show that while absolute levels of borrowings are up, delinquencies are still below pre-pandemic levels, which suggests households are not feeling overly levered. Therefore, despite increasing debt load, most individuals are still feeling relatively positive about their personal balance sheets. Separately, occam analyzes the effects of inflation on purchasing behavior and the data suggests consumers have strong beliefs on which categories of spending they will prioritize and which they are more willing to let go should they need to belt tighten.

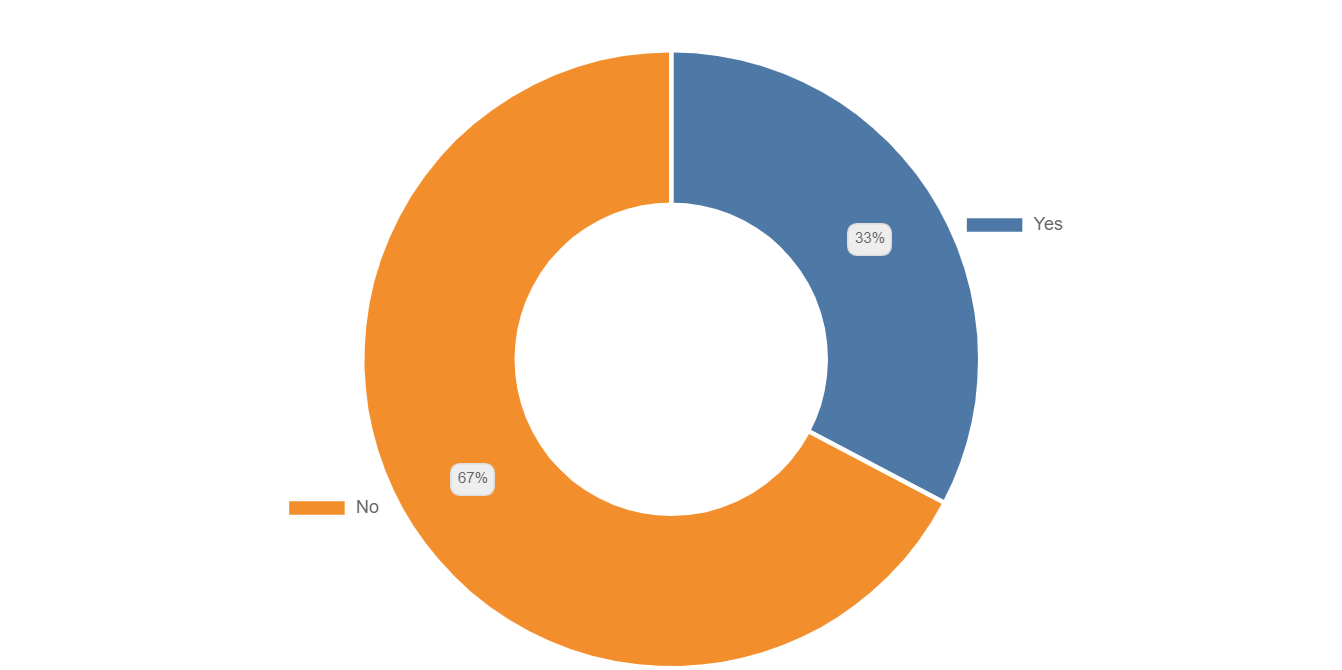

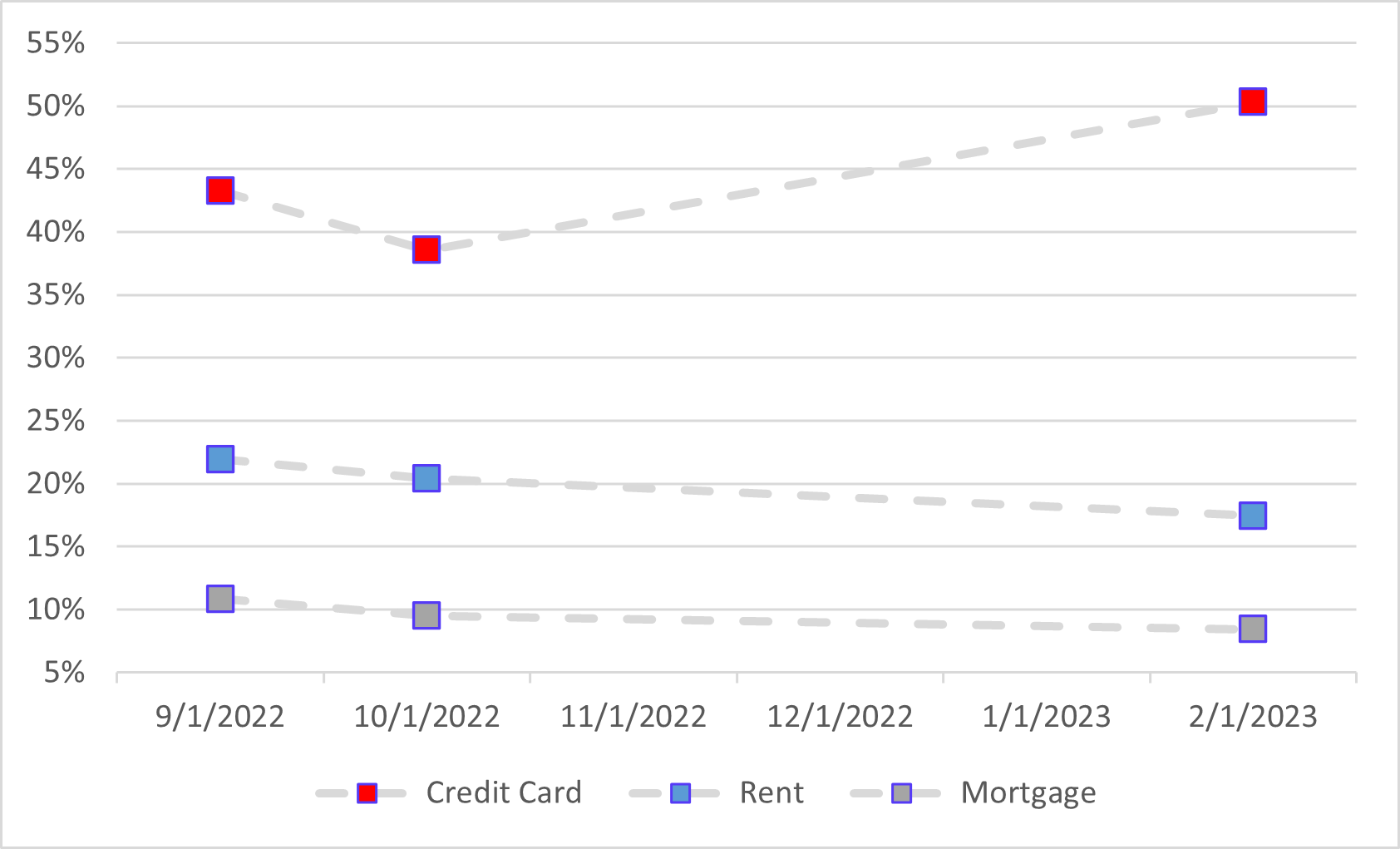

As the Fed chases its 2% inflation target through a series of interest rate hikes, consumers are straining to keep pace. As shown in Figure 1, approximately 1 out of 3 American consumers have fallen behind on their bills. Figure 2 highlights differences in credit card, rent and mortgage delinquencies over the last six months. Mortgage (and rent) payments are relatively current, whereas credit card bills are starting to see signs of stress. This could be due to high levels of mortgage refinancings when rates were low as well as because housing is a basic necessity. On the other hand, obligations like credit card delinquencies are starting to rise at a faster pace than last year, a shift occam will continue to monitor as interest rates fluctuate.

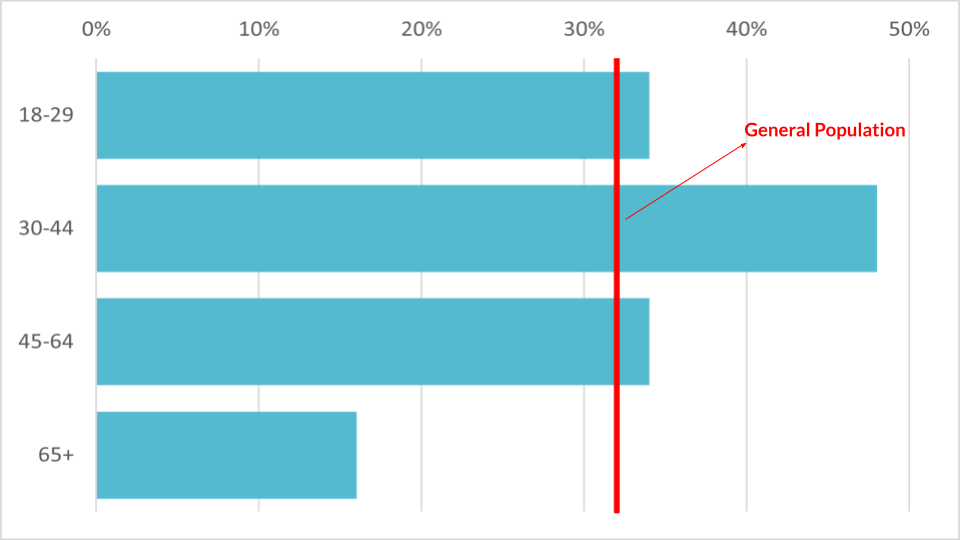

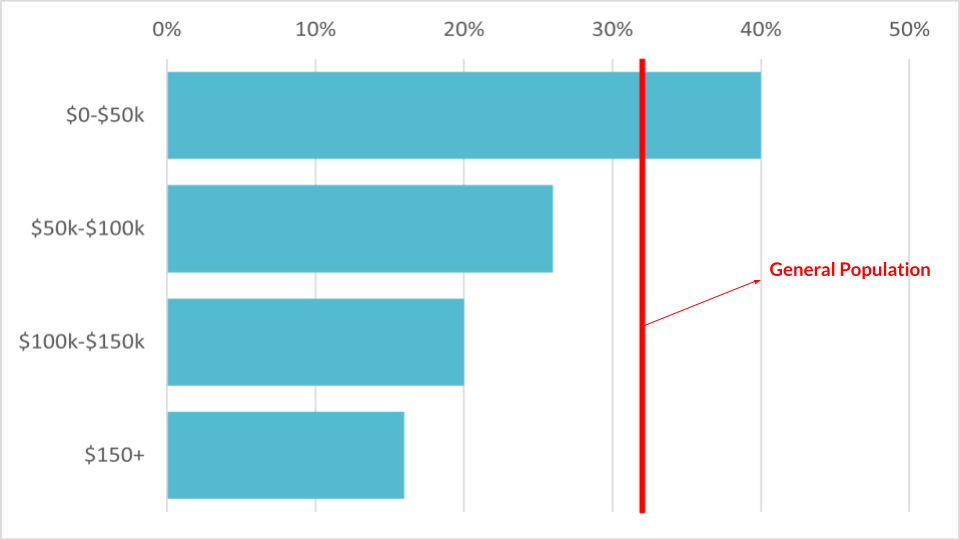

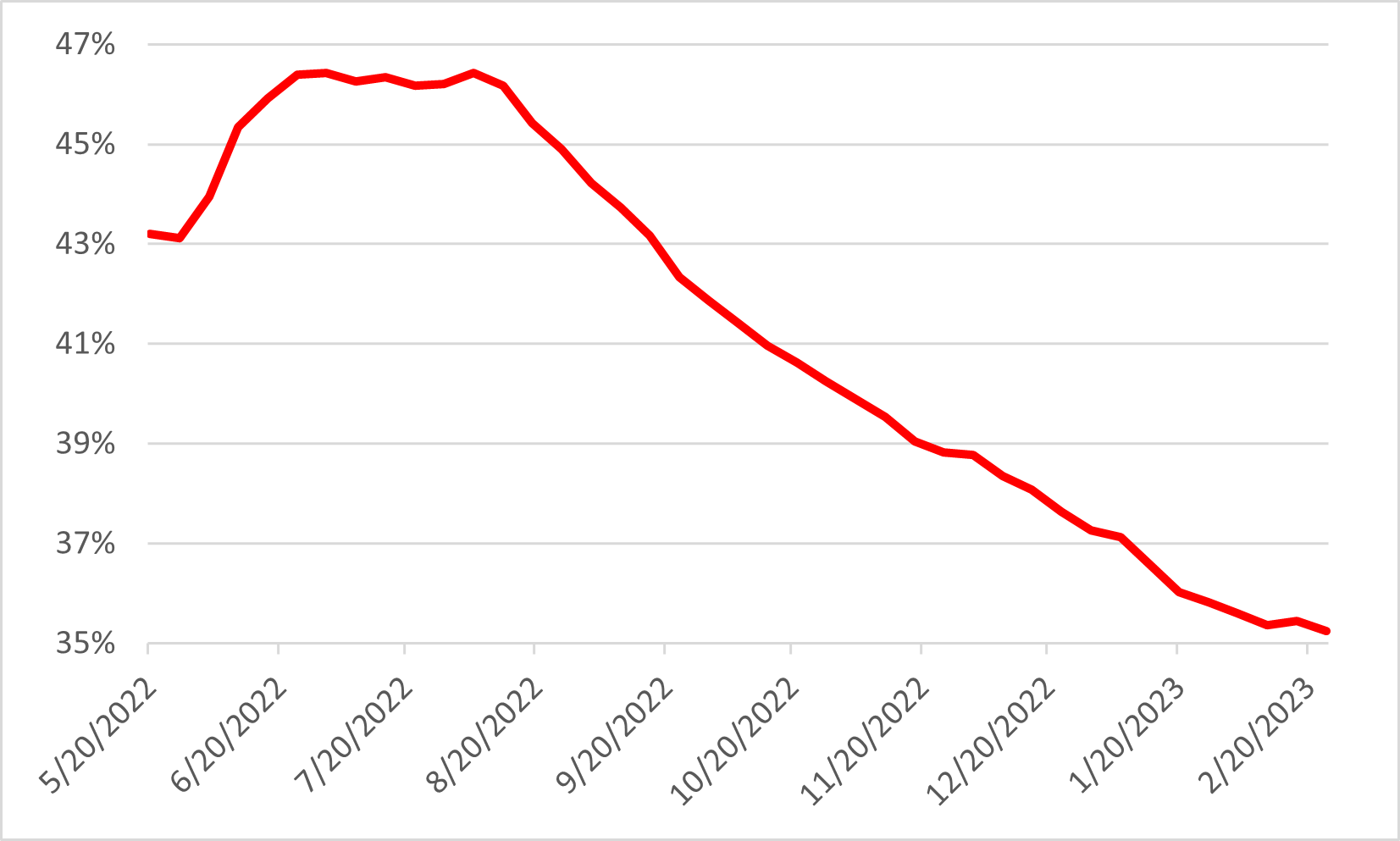

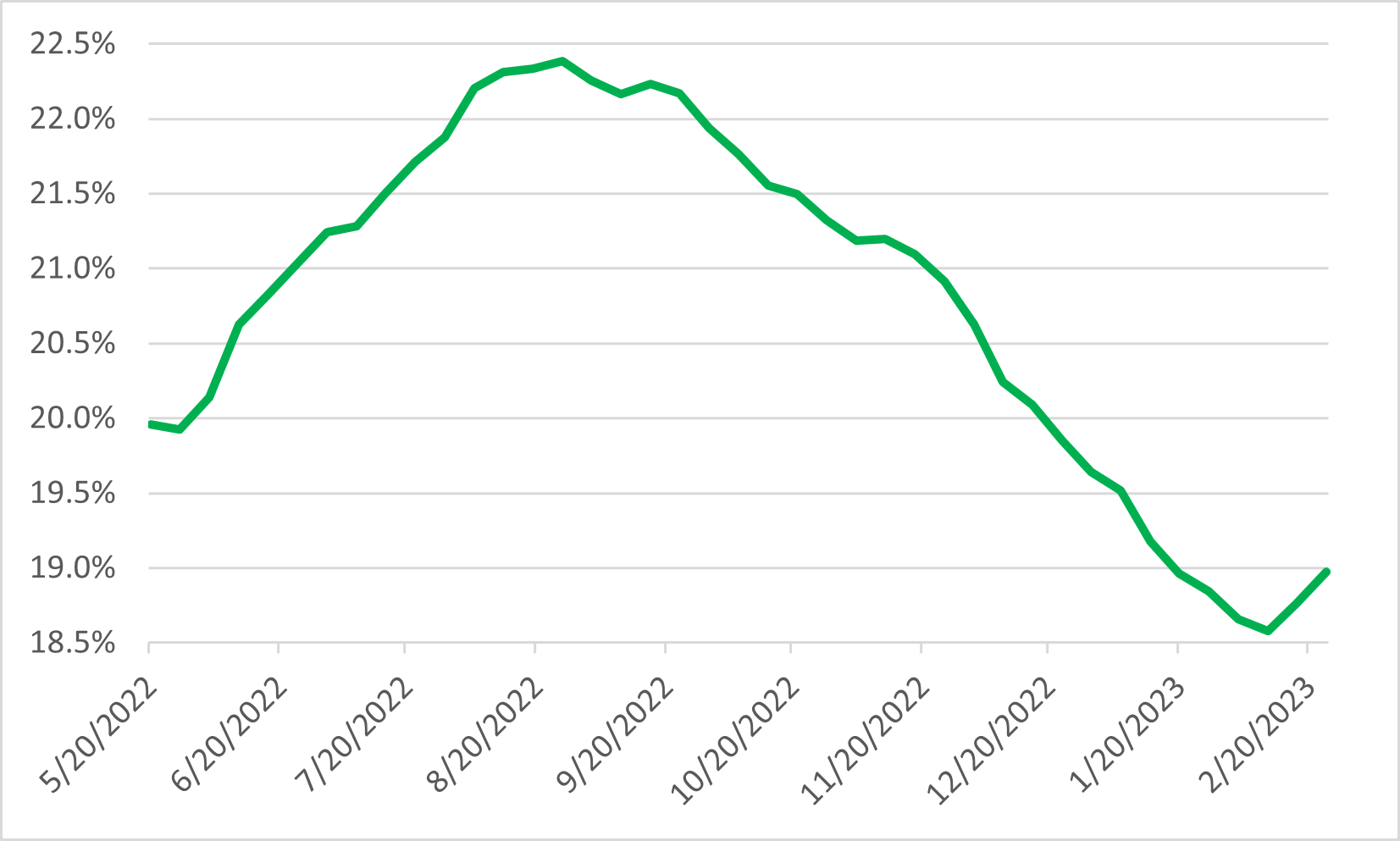

Figures 3 and 4 display the characteristics of those in arrears, or more specifically, the age and income cohorts of those overdue. Surprisingly, the age group under the highest financial stress is not the zoomer cohort, which receives the bulk of negative press, but rather, the millennials. Less surprising is the fact that the lower income cohorts are behind; over 40% of those earning under $50k are struggling to remain current.

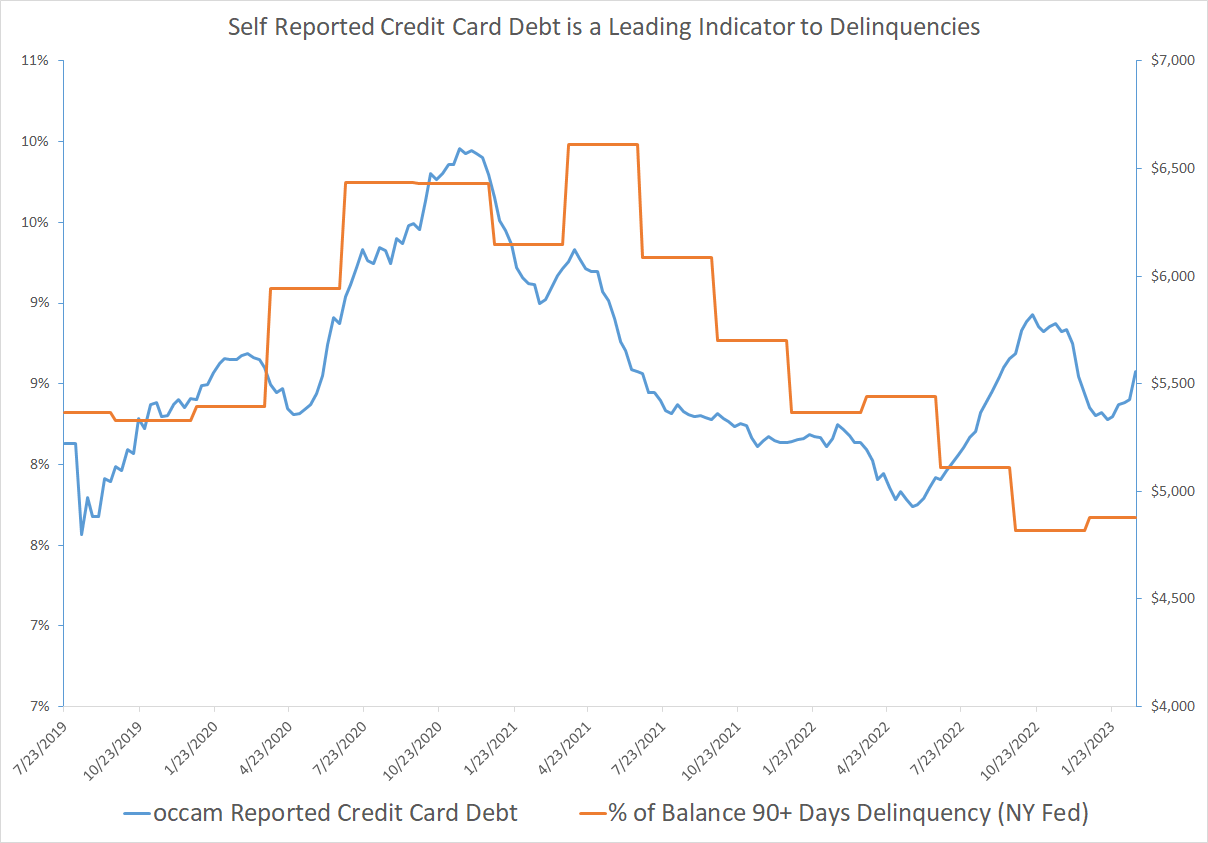

For a more multi-layered analysis of credit card debt, Figure 5 presents two essential data series: 1) a tracking of the dollar level of household credit card debt as reported to occam, 2) the percentage of credit card loans that have reached 90+ days delinquency according to the Federal Reserve Bank of New York. Readers should note that the greater the amount of credit card debt consumers state they have, the greater the delinquencies are as well. We believe rising credit card debt is a leading indicator of delinquent accounts, and that the recent rise we see in occam reported credit card debt foreshadows a rise in the NY Fed reported delinquencies. We note occam data is reported daily whereas the NY Fed report is quarterly.

Similarly, Figure 6 shows that credit card debt as reported by the NY Fed has reached all-time highs but we don’t see a corresponding rise in credit card delinquencies yet (Figure 5).

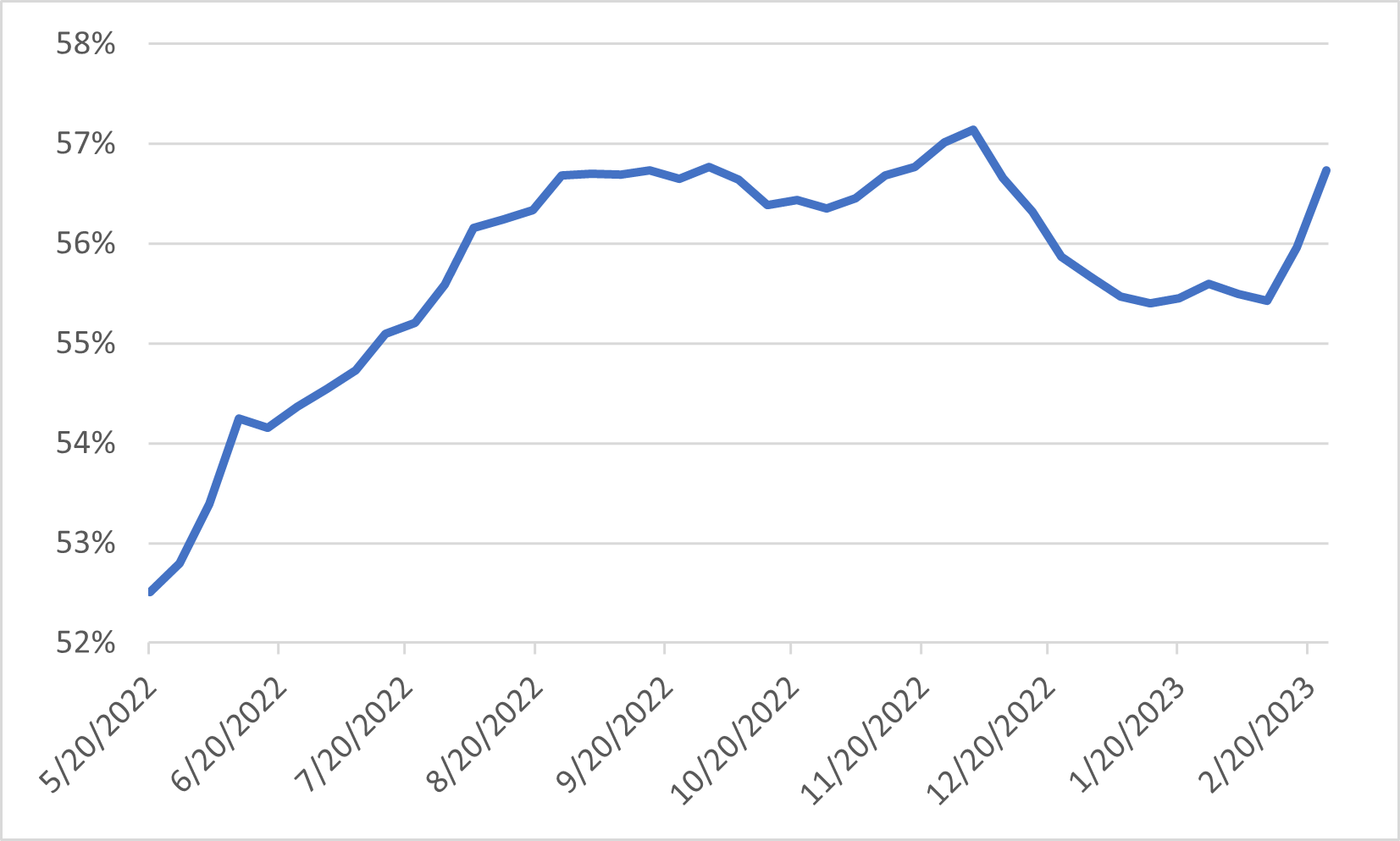

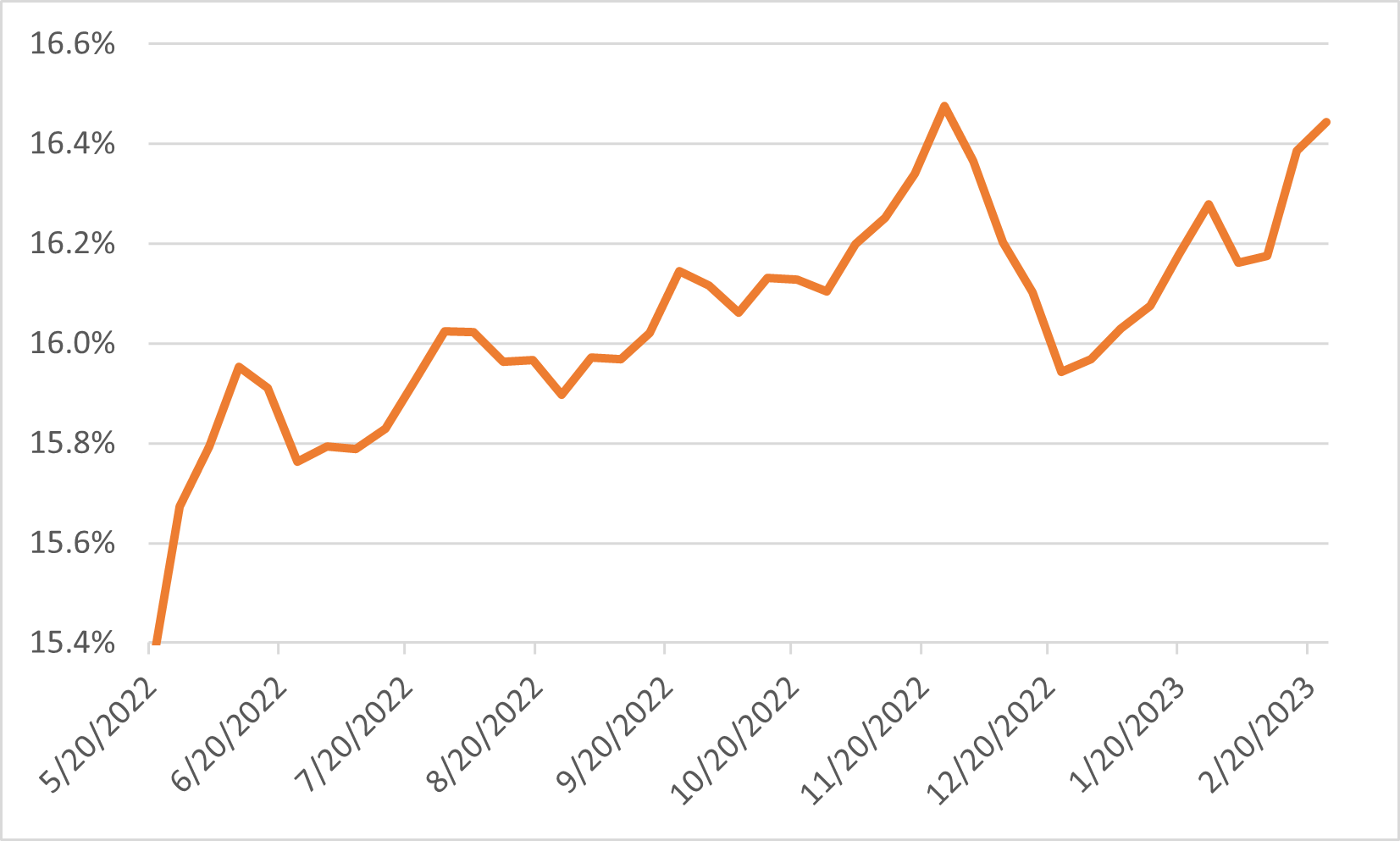

An additional dimension of the present economic circumstances to explore is the impact of high inflation on consumer spending. While recent earnings from some restaurant groups have been impressive, we see that about 57% of consumers say they are cutting back on dining out (Figure 7). (To see more of occam’s insights on dining trends, please check out our blog on coffee chains here and stay tuned for our upcoming blog on fast food!) Moreover, as highlighted by Figure 8, consumers continue to cut back on car purchases. While auto SAAR has rebounded recently, it remains below pre-COVID levels, and consumer’s preferences have not meaningfully changed.

Figures 9 and 10 illustrate that after enduring nearly three years of “slow the spread” policy, consumers are keen to get back to traveling, in spite of the increases in gas prices and airfare. However, a noteworthy digression is the recent uptick in those looking to cut back on travel. Revenge travel has been strong post the pandemic; whether or not it has hit its peak remains to be seen.

Source: Analysis based on occam™ proprietary AI-enhanced research platform with various data sources, including a wide range of questions asked to over 1000 respondents per day with over three years of history. Information is census-balanced and uses occam’s™ proprietary AI algorithm that ensures minimal sampling bias (<1%). Contact us for more info.

Debt Obligations

1. Those Who Pay Their Debts Are Soon Forgotten

One out of three American consumers are struggling to pay bills on time

Have You Fallen Behind on a Bill?

Debt Obligations

2. A Bad Master But A Good Servant

Consumers are up to date on rental and mortgage payments, but credit card obligations are getting tougher

What Type of Bill Have You Fallen Behind on?

Delinquent Accounts

3. Money Is Like A Sixth Sense

Middle-aged Americans are faltering when it comes to paying the bills

Age Distribution of Americans with Overdue Accounts

Delinquent Accounts

4. Money Is Like A Sixth Sense (Part 2)

Unsurprisingly, lower-income Americans are feeling the pinch the most

Income Distribution of Americans with Overdue Accounts

Credit Card Debt

5. A New Dawn, A New Day

Consumers are not feeling over-levered quite yet

Credit Card Debt

6. The Working Man's Blues

Consumer credit including credit card debt are back to record-highs

Consumer Spending

7. Food and Song Above Hoarded Gold

Rises in food prices and restaurant operating costs persist, holding back consumers from eating out

Those Who Recently Cut Back On Dining Out

Consumer Spending

8. Nature Does Not Hurry

Consumers who can are avoiding bigger purchases

Those Who Recently Delayed Buying a Car

Consumer Spending

9. No Problem, Just Rush Hour

Consumers are back on the road, putting quarantines and social distancing behind them

Those Who Recently Cut Back on Driving

Consumer Spending

10. Seeing Things That I May Never See Again

Vacations and holidays resume as travel restrictions fade away

Those Who Recently Canceled a Trip/Vacation

AlphaROC occam case studies are for illustrative purposes only. This material is not intended as a formal research report and should not be relied upon as a basis for making an investment decision. The firm, its employees, data vendors, and advisors may hold positions, including contrary positions, in companies discussed in these reports. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described in these case studies will be profitable. Investors should consult with their advisors to determine the suitability of each investment based on their unique individual situation. Past performance is no guarantee of future results.