In the competitive world of audio streaming, user preferences and behaviors are constantly shaping the marketing and product strategies of the major platforms. Insights from Occam reveal trends like the rising importance of offering a variety of subscription models and the growing role of podcasts and audiobooks in driving engagement. By analyzing subscription behaviors, content priorities, pricing preferences, and user demographics, Occam offers a view into the evolving audio streaming market.

Music Streaming Platforms: Subscriber Dynamics

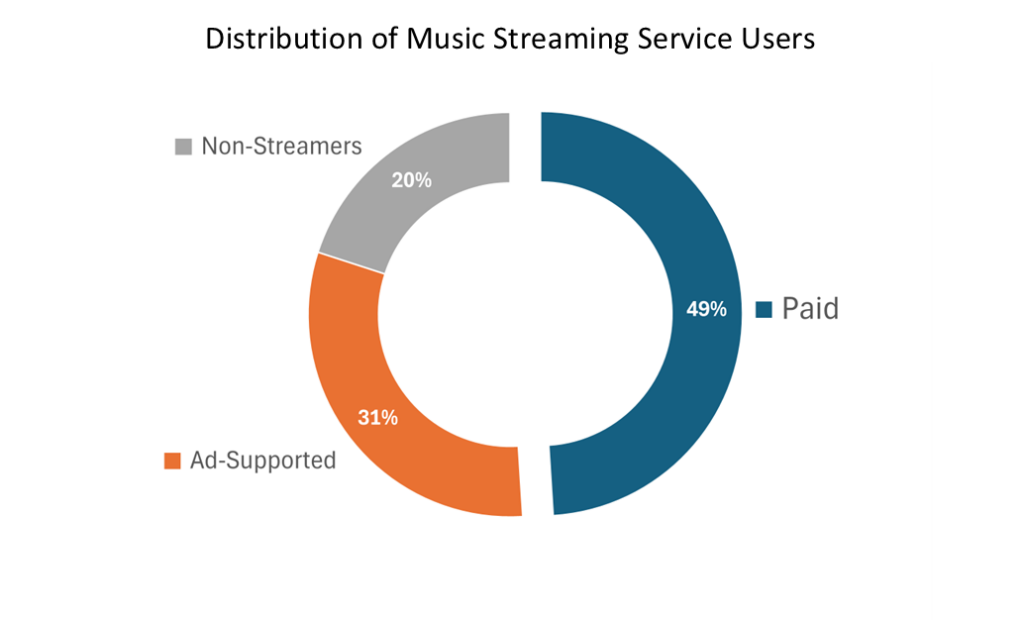

- 80% of respondents report they use a music streaming service.

- More than half of music streaming service users pay for premium subscriptions, highlighting the strong appeal of features such as ad-free listening and exclusive content.

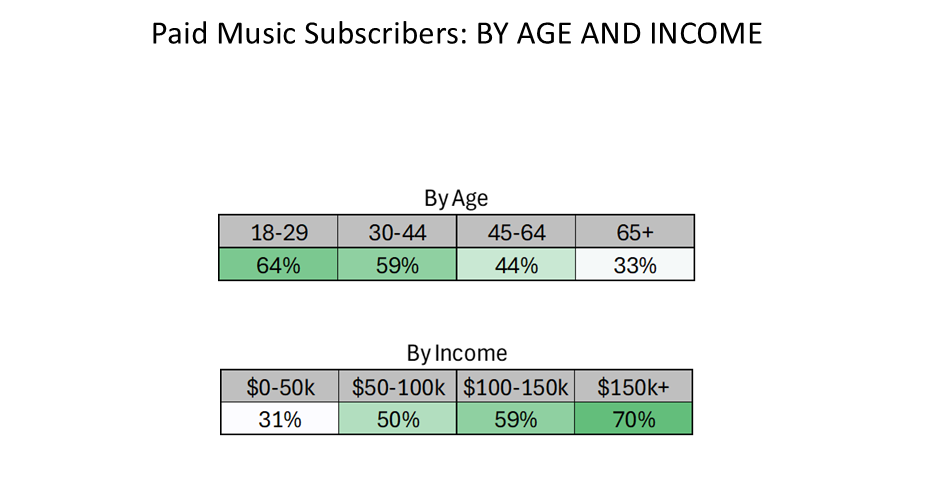

- Paid subscription rates sharply decline with age, but rise with income.

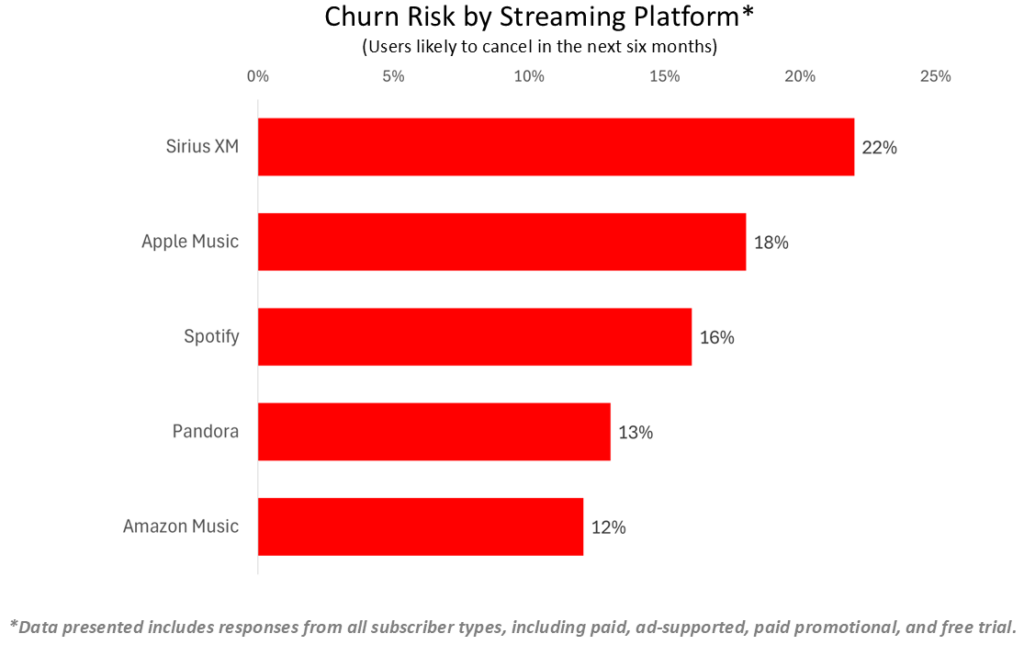

- Apple Music and Sirius face the highest churn risk with the highest proportion of users indicating they’re likely to cancel.

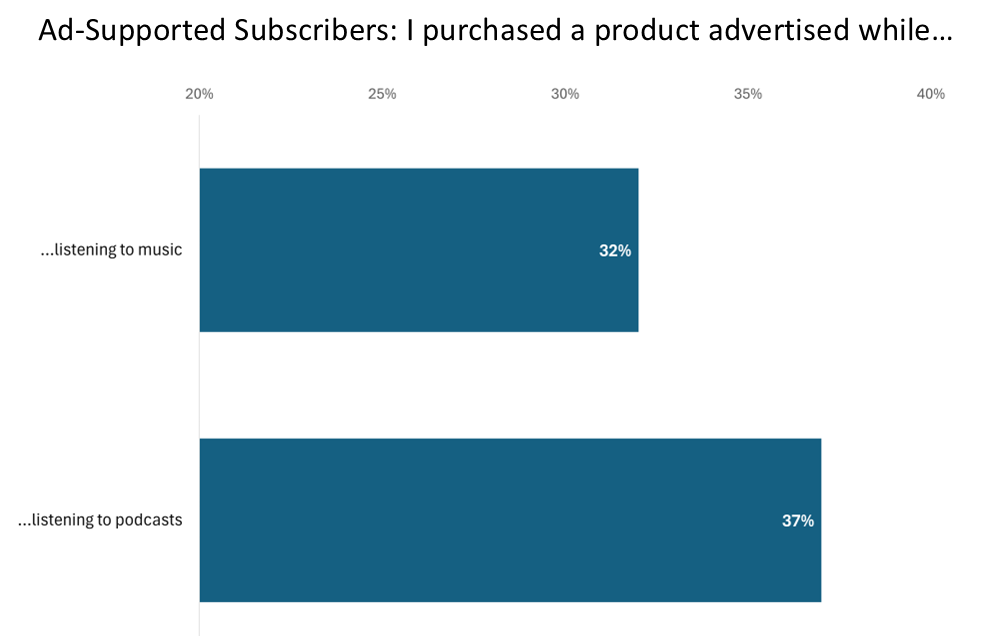

- Ad-supported subscribers are more likely to purchase products they hear advertised while listening to podcasts than while listening to music.

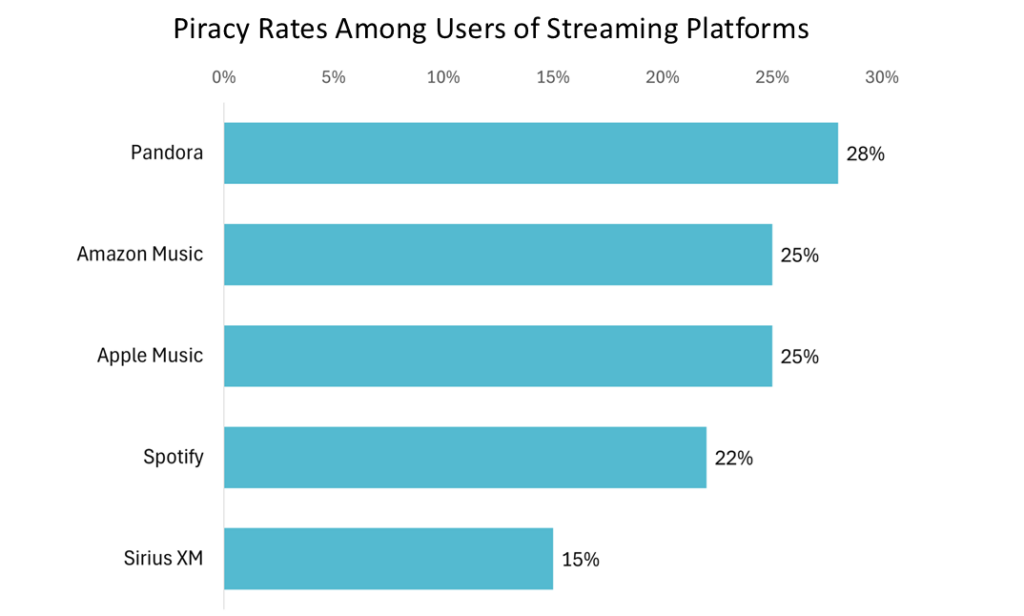

- Pandora users are the most likely to admit to pirating music, audiobooks or subscription-only podcasts.

- SiriusXM users show the lowest piracy behavior, likely because its demographic is older and less tech savvy.

The Spotify User Landscape

- As the platform with the largest market share, Spotify serves as a useful case for understanding the broader preferences and behaviors of streaming listeners.

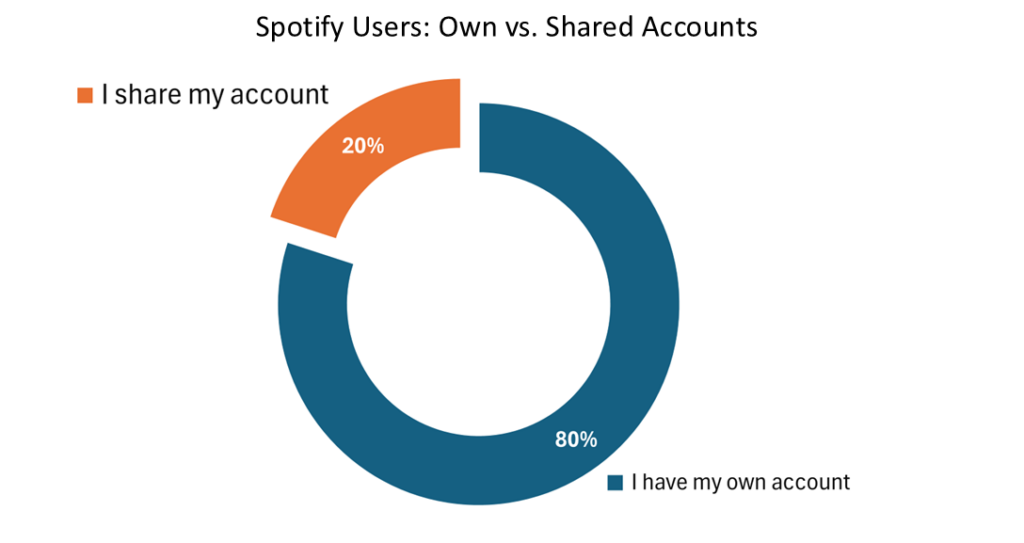

- 20% of Spotify listeners are using a shared account, which might suggest opportunity for the expansion of family or group plans.

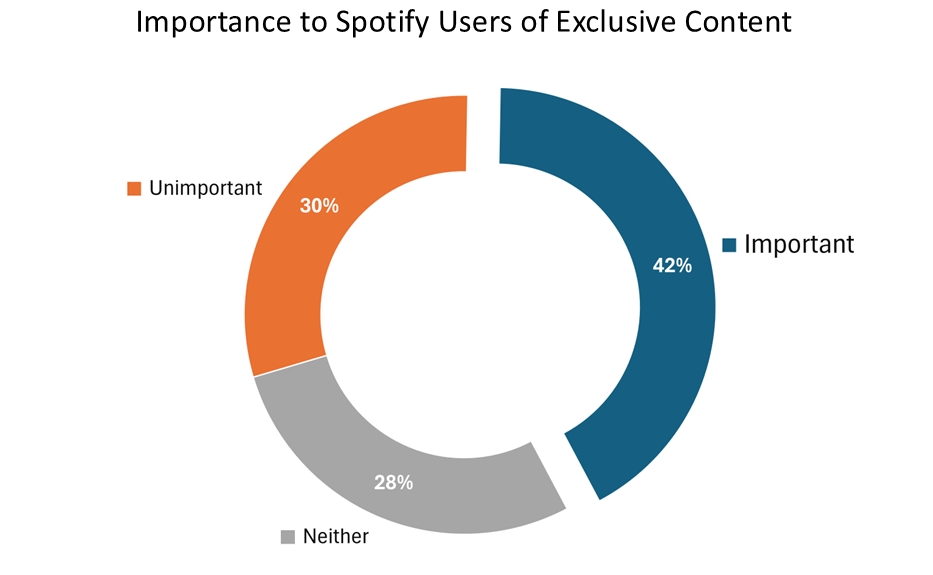

- A substantial 42% of Spotify users consider exclusive content important, emphasizing its role in enhancing stickiness of the service.

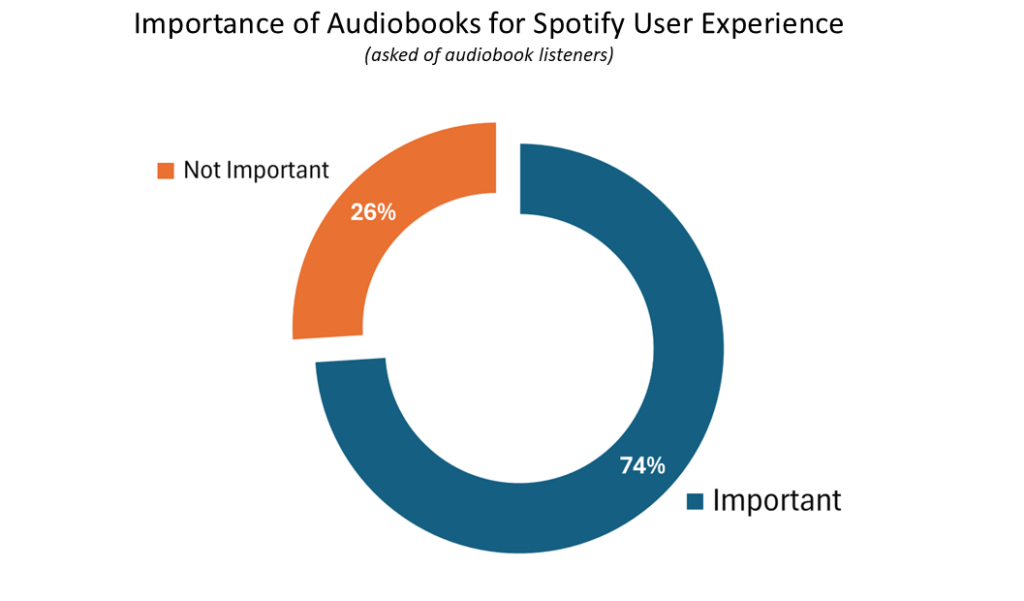

- Spotify’s audiobook offering is crucial for audiobook listeners paying for the full Spotify experience.

Content Expansion: Podcasts and Audiobooks

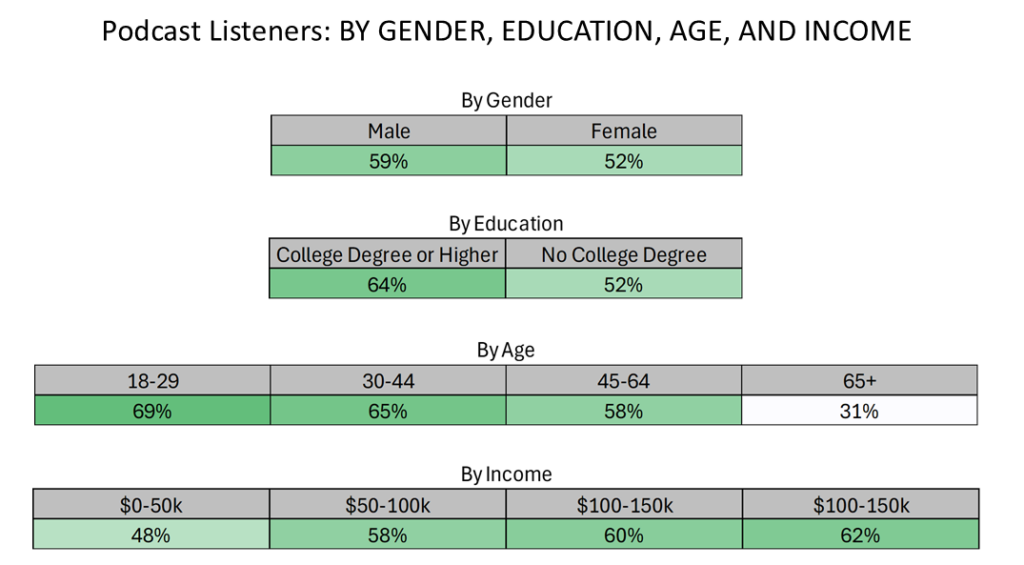

- Those with a college degree are much more likely to listen to podcasts.

- Interestingly, 45-64 year olds are almost as likely to be podcast listeners as those 18-44.

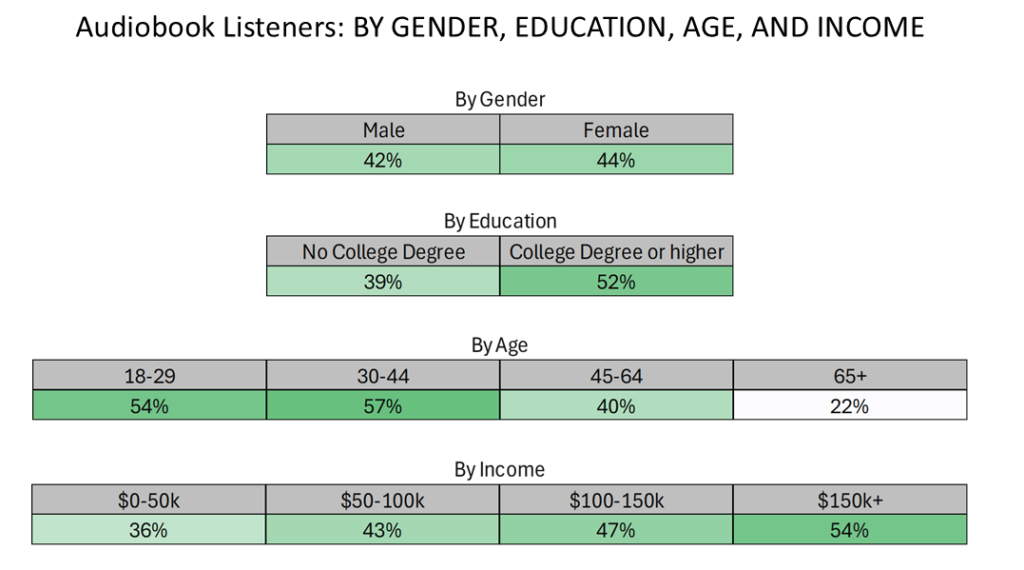

- Higher earners are more likely to be audiobook listeners, as are college graduates.

- Engagement also skews towards middle-aged cohorts.

Audiobook Subscriptions

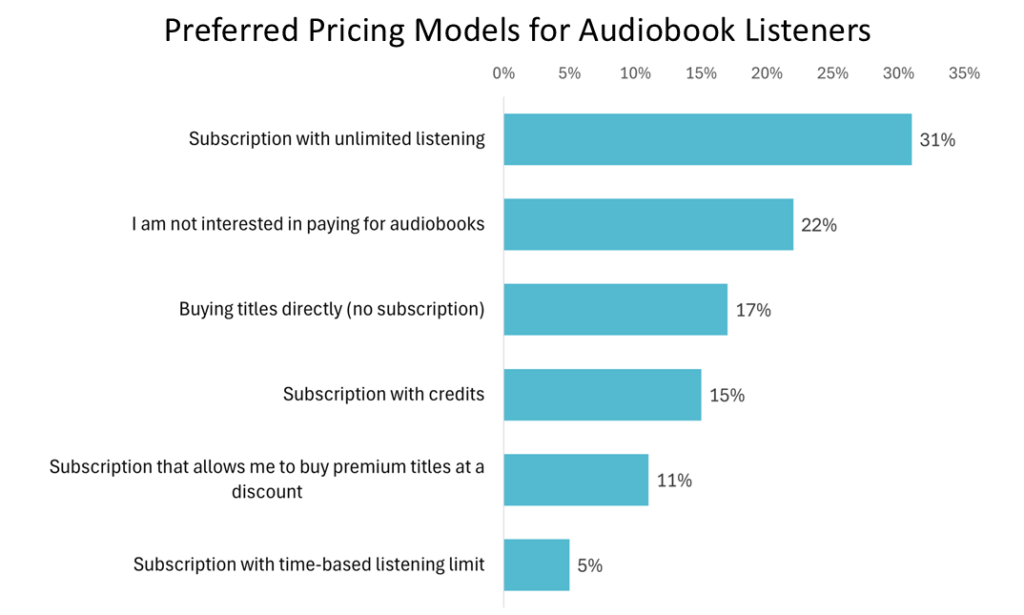

- A plurality of audiobook listeners prefer subscription models with unlimited listening or time-based limits, likely because these options offer flexibility to explore or abandon books without significant commitment.

- Fewer listeners favor models that require buying individual titles or purchasing credits to spend on specific titles.

Source: Analysis based on occam™ proprietary AI-enhanced research platform with various data sources, including a wide range of questions asked to over 1000 respondents per day with over three years of history. Information is census-balanced and uses occam’s™ proprietary AI algorithm that ensures minimal sampling bias (<1%). Contact us for more info.

AlphaROC occam case studies are for illustrative purposes only. This material is not intended as a formal research report and should not be relied upon as a basis for making an investment decision. The firm, its employees, data vendors, and advisors may hold positions, including contrary positions, in companies discussed in these reports. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described in these case studies will be profitable. Investors should consult with their advisors to determine the suitability of each investment based on their unique individual situation. Past performance is no guarantee of future results.